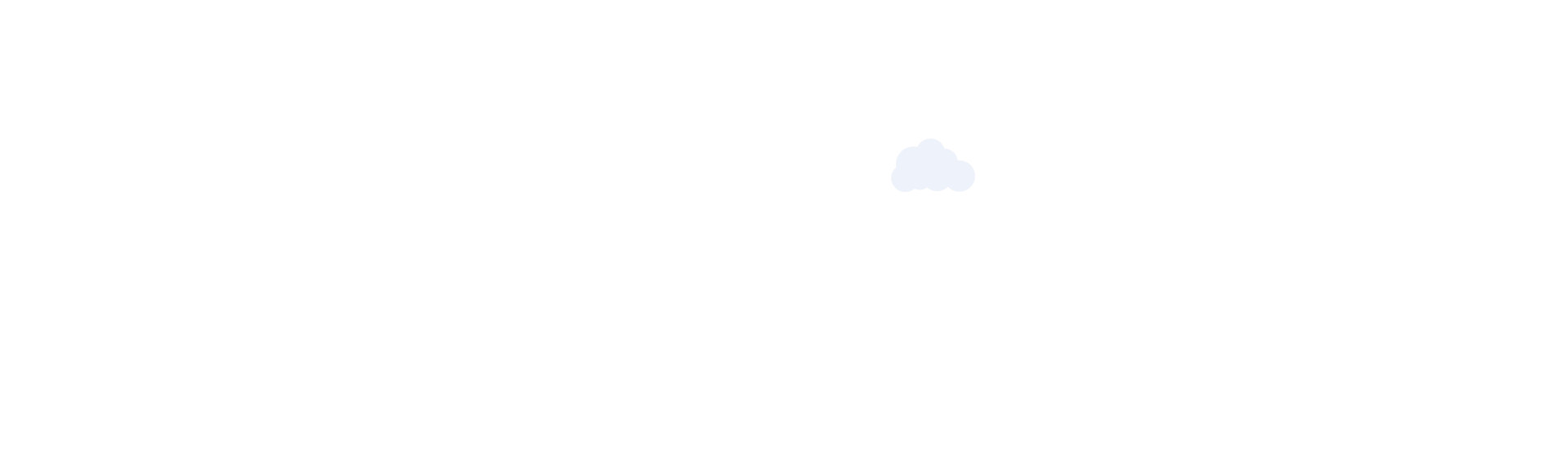

As businesses scale and their internet traffic grows, understanding the intricacies of internet interconnection becomes crucial. Two key concepts in this domain are IP peering and IP transit. Though they may seem similar, they serve different purposes in optimizing an enterprise’s internet connectivity.

IP peering is a mutual exchange of data between two internet service providers (ISPs). This arrangement is typically settlement-free, meaning neither party charges the other for the data exchanged. The primary advantage of IP peering is that it allows for direct data exchange, which can reduce latency and improve network performance. Peering can be public or private:

Public Peering: This occurs at an Internet Exchange Point (IXP), where multiple networks connect to exchange traffic. It leverages the Border Gateway Protocol (BGP) to efficiently route traffic through a single IXP.

Private Peering: This involves a dedicated connection between two networks, ideal for large volumes of traffic, offering greater control and performance compared to public peering.

However, peering requires careful management and negotiation, as each party must agree on the terms of the traffic exchange, including how much traffic is allowed and which routes are accessible.

While peering is a direct relationship between two networks, IP transit is a commercial service where one network (the customer) pays another network (the provider) to deliver traffic to the rest of the internet. In essence, IP transit gives a network access to the global internet by leveraging the provider’s extensive network connections.

IP transit providers typically have large, well-connected networks with multiple peering and transit relationships, ensuring that their customers can reach any destination on the internet. The transit provider not only delivers the customer’s traffic to its final destination but also provides inbound access, allowing other networks to send traffic back to the customer.

IP transit is crucial for networks that require comprehensive internet access. Unlike peering, where traffic is exchanged only between two networks, IP transit covers the entire internet, making it essential for businesses that need to reach a global audience. This service is typically charged based on the volume of traffic sent and received, often measured in megabits per second (Mbps).

Cost Structure: IP peering is generally cost-effective as it is often settlement-free, whereas IP transit involves a recurring cost based on bandwidth usage.

Network Control: Peering provides more control over routing and can reduce dependency on third-party networks, while transit offers broader reach but less control.

Performance: Peering can enhance performance by reducing latency and potential points of failure, whereas transit ensures connectivity to a wider range of networks.

Enterprises might opt for IP peering when they have significant traffic with specific networks. For instance, if a company frequently exchanges data with another large network, peering can reduce costs and improve performance. Peering is also beneficial for content delivery networks (CDNs) and large-scale web services that require efficient and reliable data exchange.

IP transit is ideal for enterprises that need comprehensive internet access. It is particularly useful for smaller companies or those without the traffic volume to justify peering. Transit ensures that an enterprise can reach any part of the internet, making it a versatile solution for general internet connectivity.

When deciding between IP peering and IP transit, enterprises should consider their specific needs and traffic patterns. A hybrid approach, using both peering and transit, can often provide the best balance of cost, performance, and reliability. For example, an enterprise might use peering for high-volume traffic with specific networks and transit for broader internet access

ISPs can deliver bandwidth with lower latency and lower costs through peering with exchanges and content networks. This will greatly help in providing a better quality service and better end-user Internet experience. ISPs also need reliable OSS/BSS software to help deliver flexible Internet plans and manage business operations. Jaze ISP Manager in integration with BNG routers helps ISPs deliver service and manage operations. Click here for more information. Click here to learn more.

The cloud infrastructure market continues to expand at an impressive rate, with global spending reaching over $76 billion in the first quarter of 2024. As businesses increasingly rely on cloud services for their operations, the competition among cloud providers has become more intense, with the “Big Three”—Amazon Web Services (AWS), Microsoft Azure, and Google Cloud—dominating the market.

Amazon Web Services (AWS) has long been the frontrunner in cloud infrastructure, maintaining a 31% market share in Q1 2024. However, its closest competitor, Microsoft Azure, is steadily gaining ground, reaching an all-time high of 25% market share during the same period. Combined with Google Cloud’s 11% share, these three giants control approximately two-thirds of the global cloud market.

The market’s rapid growth is reflected in the annualized run rate, which has now reached $300 billion, growing at 21% year-over-year. This substantial expansion, despite the market’s size, highlights the increasing demand for cloud services as businesses transition from traditional data centers to more flexible and scalable cloud-based solutions.

As the cloud market continues to evolve, peering with content providers has become a crucial aspect of cloud infrastructure services. Peering refers to the direct interconnection between networks, allowing for the efficient exchange of data without relying on third-party transit providers. This direct connection enhances the performance, reliability, and security of cloud services, making it an essential feature for major cloud providers.

Both AWS and Microsoft Azure have established peering agreements with various content providers, enabling them to deliver faster and more reliable services to their customers. These peering arrangements are particularly important for businesses that rely heavily on content delivery, such as streaming services, e-commerce platforms, and online gaming.

Peering offers several advantages that contribute to the growing dominance of AWS, Azure, and Google Cloud in the cloud infrastructure market:

1. Reduced Latency: Peering allows for the direct exchange of data between networks, minimizing the distance that data needs to travel and thereby reducing latency. This is especially important for time-sensitive applications such as real-time video streaming, online gaming, and financial transactions.

2. Improved Network Performance: By bypassing third-party networks, peering can reduce the likelihood of network congestion and improve overall performance. This leads to a more reliable user experience, which is critical for businesses that depend on cloud services for their daily operations.

3. Enhanced Security: Peering eliminates the need for data to pass through multiple networks, reducing the risk of interception or attacks.

4. Cost Efficiency: Peering can reduce the costs associated with using third-party transit providers. For cloud service providers, these savings can be passed on to customers, making their services more competitive in the market.

The cloud infrastructure market’s growth is being driven by the increasing demand for scalable, efficient, and secure cloud services. As AWS, Microsoft Azure, and Google Cloud continue to dominate the market, their ability to provide superior performance through peering agreements with content providers will play a significant role in maintaining their competitive edge.

In modern broadband networks, over 50% of traffic is routed through peering with Internet Exchanges, significantly lowering transit costs and reducing latency. Jaze ISP Manager allows you to set policies that optimize your use of peering networks, supported by BNGs, ensuring an enhanced experience for your subscribers. Click here to learn more.

In recent years, India has experienced a remarkable increase in wired broadband subscribers, reaching 39.4 million as of February 29, 2024. This represents a 20% growth compared to the previous year, according to the Telecom Regulatory Authority of India (TRAI). Despite this impressive growth, wired broadband penetration remains relatively low at around 10%, underscoring the continued dominance of mobile internet usage in the country.

The COVID-19 pandemic has played a pivotal role in driving the adoption of broadband internet delivered via optical fibre cables. As people shifted to remote work, online education, and digital entertainment, the demand for reliable and high-speed internet connections surged. This trend is part of a broader rise in broadband adoption in India, with the overall subscriber base growing from 392 million in February 2018 to 916 million in February 2024.

The year-on-year growth rates for broadband subscribers were 16% in 2021, 19% in 2022, and 23% in 2023. However, the month-on-month growth rates from February 2023 to February 2024 ranged from 1.3% to 1.7%, slightly lower than the 2.5% to 3% range observed from 2022 to 2023. This indicates a steady but slightly decelerating growth trend.

Currently, internet services in India are delivered through three primary modes: wired lines, mobile devices, and wireless radio spectrum. The Telecommunications Bill 2023 has introduced provisions for spectrum allocation for satellite-based services without the need for auctions. This could pave the way for providers like Airtel’s OneWeb and Elon Musk’s Starlink to offer satellite-based internet services in India.

Despite the recent growth in wired broadband, penetration levels in India are still low compared to the 80-90% adoption rates seen in the US, China, and European markets. The widespread use of smartphones has led 95% of the Indian population to connect to the internet via mobile devices. As of February 2024, there were 876 million mobile data users compared to 39 million wired broadband subscribers. On average, Indian users consumed 24 GB of data per month on mobile devices in 2023.

As the demand for high-speed internet and seamless streaming experiences grows, ISPs must adapt to evolving technologies and customer expectations. Advanced BNG routers are essential for handling increased bandwidth, and the need for automated operations has never been greater. Jaze ISP Manager is designed to seamlessly integrate with top BNG providers, enabling ISPs to scale efficiently while automating service delivery and billing. Click here to learn more.

The landscape of entertainment consumption has dramatically transformed with the rise of video streaming, marking a significant shift from traditional broadcast TV to internet-based services.

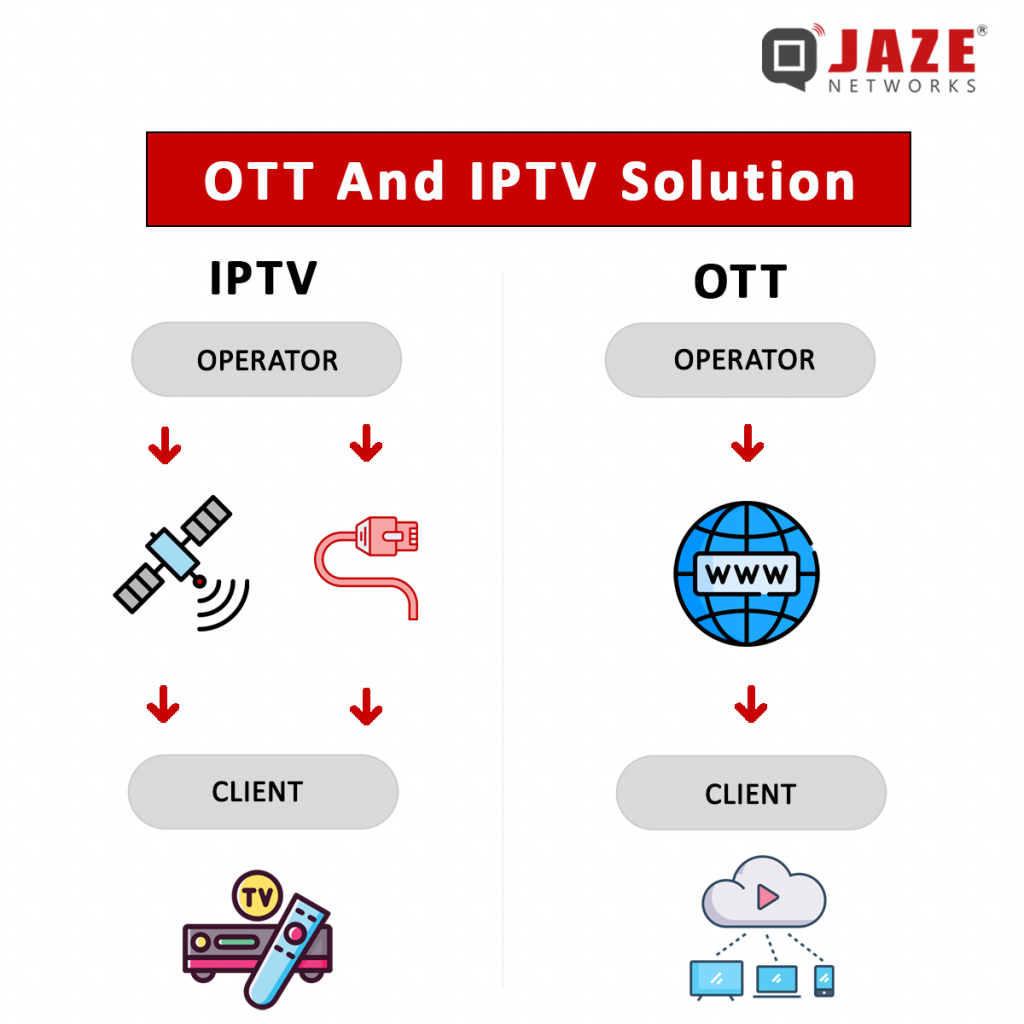

As video streaming becomes increasingly popular, two key technologies have emerged: IPTV and OTT services.

According to recent data from Statista, the OTT video market is anticipated to reach approximately 6.4 billion users by 2029. Meanwhile, the global IPTV market was valued at USD 59.68 billion in 2022. But what are IPTV and OTT, and how do they differ?

Network Type: IPTV operates on a closed, managed network provided by Internet Service Providers (ISPs). This ensures a controlled environment for content delivery, leading to more stable and reliable streams.

OTT services utilize the open, public internet, making them accessible from anywhere with an internet connection.

Monetization Models: IPTV services are typically subscription-based and often bundled with other internet services provided by ISPs.

OTT services offer more flexible monetization options, including both subscription-based and ad-supported models. This variety allows OTT platforms to cater to different user preferences and budgets, providing more accessibility and choice.

Content Quality: IPTV is known for delivering high-quality, reliable streams due to its controlled network conditions. The managed network minimizes buffering and interruptions, ensuring a smooth viewing experience.

OTT content quality, however, can vary significantly based on the viewer’s internet speed and network congestion.

Accessibility: IPTV services are limited to the service provider’s network, often making them region-specific. This means that users can only access IPTV content within the geographical area covered by their ISP.

OTT services are globally accessible as long as there is an internet connection. This global reach allows users to access content from anywhere in the world, making OTT a more versatile option for international viewers.

Equipment: To access IPTV services, users typically need a set-top box and sometimes additional hardware. This equipment is necessary to decode the IPTV signal and deliver it to the TV.

OTT services are accessible on a wide range of devices without the need for special equipment. Users can stream OTT content on smartphones, tablets, smart TVs, and computers, providing greater convenience and flexibility.

Operational Costs: IPTV services incur higher operational costs due to the need for dedicated infrastructure and equipment. These costs are often passed on to consumers through higher subscription fees.

OTT services leverage existing internet infrastructure, resulting in lower operational costs.

IPTV, or Internet Protocol Television, delivers television content through a private, managed network. This means that the service provider controls the entire delivery process, ensuring a high-quality, reliable viewing experience. IPTV typically requires a subscription and a set-top box to decode the signal and deliver it to your TV.

Once the setup is complete, users can enjoy a wide range of TV programming over their internet connection. In essence, IPTV represents a shift towards a more flexible and efficient television experience, offering on-demand access to a diverse array of programming through a managed network.

OTT, or Over-The-Top, refers to content delivered over the public internet. Unlike IPTV, OTT does not require a managed network or a set-top box. Instead, it can be accessed on a wide range of devices, including smartphones, tablets, smart TVs, and computers. Popular OTT services include Netflix, Hulu, and Amazon Prime Video.

While both IPTV and OTT offer unique advantages, OTT services have become the preferred choice for many consumers and providers. The flexibility and lower cost of OTT platforms make them more appealing, especially in today’s mobile-first world where users value the ability to watch content on-the-go.

OTT services also stand out for their user-friendly nature. There’s no need for specialized equipment or installation—just an internet connection and a device. This ease of use, combined with a vast library of on-demand content, has contributed to the widespread adoption of OTT over IPTV.

Choosing between IPTV and OTT depends on your specific needs and preferences. IPTV might be ideal for those seeking high-quality, live streaming within a controlled network, especially for events like sports. However, for most users, OTT offers a more versatile and cost-effective solution, allowing access to a broad array of content across multiple devices.

With ISPs offering multiple services, managing billing and services for OTT and IPTV can be challenging. Jaze ISP Manager simplifies this process by integrating with top OTT and IPTV platforms and aggregators. It automates billing and efficiently manages OTT and IPTV services, including activation and deactivation. Additionally, Jaze ISP Manager integrates with leading BNG providers to help deliver differentiated policies, enhancing the Quality of Experience for the ISP’s subscribers. Click here to learn more.